Do you want to learn more about strata title insurance?

Nowadays, more and more Australians prefer strata living. Strata living comes with it a bunch of benefits for people looking to not just live in a nice home but also be a part of a strong, friendly community. Beyond the fact that strata living is generally a more affordable housing option, it’s community living that makes strata unique from other types of residential real estate.

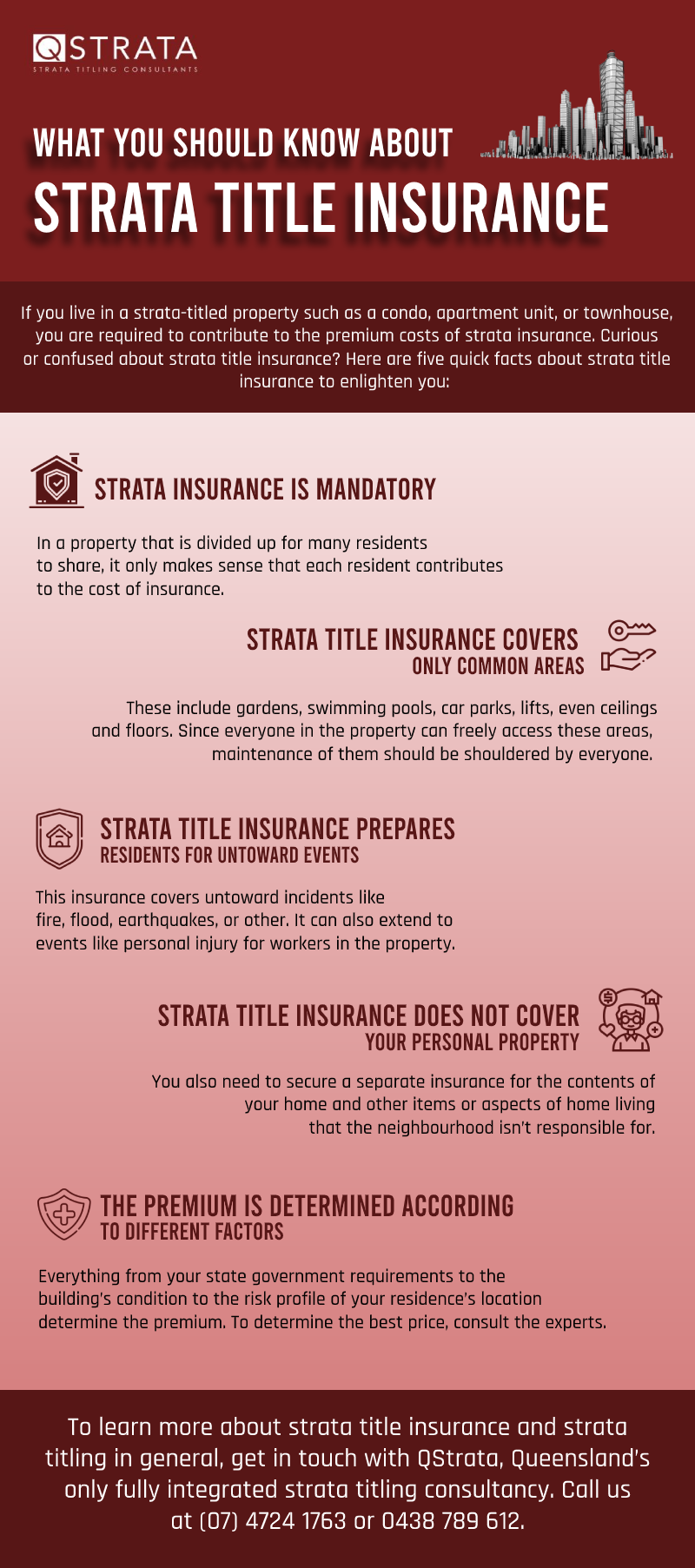

Then again, it’s also this community system that makes residential strata title insurance qld a little more complicated. If you’re planning on moving into a strata property, read on to learn more about the type of insurance you need to live there worry-free.

What is residential strata title insurance?

To understand strata title insurance qld, let’s break down what a “strata title” is first. If a property is strata titled, that means that the ownership of that property is divided among its residents. Residents own:

The unit that they live on. This may be their apartment, unit, or townhouse. No one else owns this except the resident in that specific portion of the strata.

The common grounds in a property, such as the facilities, driveways, gardens, pools, and gyms, are owned by the body corporate which is made up of all of the owners.

When you live in a strata property, you are automatically a part of a community of homeowners that don’t only act as your next-door neighbours but are the official body that is tasked to maintain the items and areas you all share ownership of. Essentially, it is a communal body where you protect each other’s investment. Acquiring residential strata insurance in QLD is the wisest move you can make as a registered owner.

What does this insurance cover?

Buildings

No matter how strong or well-constructed a building is, it can still be vulnerable to a number of risks, such as environmental damage or technical breakdowns. If ever these happen, your strata insurance will help you pay your contribution for its repair. Strata insurance also covers maintenance and repair for common contents inside the building or property, such as fences, car parks, etc.

Liability

If people become injured while on common property, you also have to share in the payment of their medical and other costs. Strata insurance also covers voluntary workers’ death or injury costs. Voluntary workers are not paid employees (usually neighbours or guests) but have decided to do some work for the strata.

Fidelity Guarantee

If ever you encounter disputes that prove there was theft, embezzlement, misappropriation of funds, conversion, or fraud in your dealings with co-owners or strata managers, strata insurance covers your loss of funds.

Office Bearers Liability

If you are an office bearer in your strata scheme – meaning if you are the chairperson, treasurer, or secretary in a strata committee – strata insurance covers loss for errors committed within your capacity as an office-bearer. To minimise this risk, office bearers are usually experienced strata managers who are real estate professionals hired by homeowners to assist them in fulfilling their responsibilities as registered owners.

Workers Compensation

If workers are injured while working on a property, contractors may hold the strata liable and may demand the strata to cover medical costs. Employees of the property such as maintenance workers will also be covered by workers compensation if they are injured while on the job.

Machinery Breakdown

This refers to equipment such as pressure pipe systems, electronic equipment, elevators, HVAC systems, and other similar equipment.

Catastrophe Insurance

Whether or not a catastrophe occurs, your property would already be insured under ‘property damage.’ But catastrophes aggravate circumstances and may cause your repair costs to shoot up. Catastrophe insurance extends your property insurance, but only during this specified context.

What does strata insurance not cover?

It does not cover a resident’s personal belongings or the contents of the property you individually own. If robbery or theft occurs, for example, strata insurance will not be able to financially cushion the damage done.

Strata title insurance can give potential residents the financial reassurance they need before purchasing a strata property

At QStrata, we look out for both owners/developers and potential residents’ welfare. While we don’t process strata insurance ourselves, we strongly recommend homeowners to obtain strata title insurance qld in the process of obtaining property. We also recommend owners and developers to encourage potential buyers to acquire strata insurance. This ensures that their share in the property is responsibly handled.

To learn more about strata titling and strata schemes in general, get in touch with us today

You can contact QStrata through the following channels:

Phone: (07) 4724 1763

Mobile: 0438 789 612

Email: admin@qstrata.com.au

You may also leave us a message via our online enquiry form. We offer the best strata title consultancy services in Queensland.